आज की इस पोस्ट में हम जानेंगे की कैसे हम GSTR-1 रिपोर्ट को टैली से सीधे ही GST पोर्टल पर अपलोड कर सकते है

अथवा Excel में Export कर सकते है, तो इसे समझने के लिए पूरी पोस्ट को ध्यान से

पढ़े.

File and Export GSTR-1 Tally to GST Portal

Tally.ERP 9 में आप तीन आसान तरीकों से GSTR-1 को फाइल कर सकते हैं:

1- Tally.ERP 9 से JSON Format में जेनरेट करके,

2- GST ऑफलाइन टूल का उपयोग करके

3- सीधे GST पोर्टल पर फाइल करके।

GSTR-1 रिपोर्ट में एक

निश्चित अवधि में की गई सभी बाहरी आपूर्ति (all outward supplies) का विवरण शामिल होता है।

उपरोक्त 3 विधियों से हम टैली से GSTR -1 को GST पोर्टल पर फाइल कर सकते है :-

Method 1: Generating JSON Format from Tally.ERP 9

Generate GSTR-1 returns in the JSON format Steps below :-

1. Go to Gateway of Tally > Display > Statutory

Reports > GST > GSTR-1.

2. F2: Period: Select the period for which returns need to be filed.

3. F12: Configure: To view the

export options for HSN/SAC details, enable Show HSN/SAC Summary?

4. Press Ctrl+E.

5. Press Enter to export.

Compress the JSON file generated from Tally.ERP 9 in

the .zip format and upload it to the portal for filing returns.

जीएसटी रिटर्न ऑनलाइन कैसे फाइल करें

File GSTR-1 Returns

1. Log in to the GST portal.

2. Click Services > Returns > Returns Dashboard.

3. Select the Return Filing Period, and click Search.

4. Click PREPARE OFFLINE.

5. Click Choose File to

import the JSON file generated from Tally.ERP 9 or the offline tool.

Note :- Once your JSON file is uploaded successfully, you will be

notified by a message.

6. Verify the uploaded details after

the time specified in the GSTR screen.

You have to manually enter the details for Nil Rated

Supplies and Documents Issued by referring to the table-wise

format of GSTR-1, because these details do not get directly uploaded to

the portal.

7. Go to Services > Returns > Returns

Dashboard, and click Prepare Online.

8. Go to the 8A, 8B, 8C, 8D - Nil

Rated Supplies page, and enter the details.

9. Go to the 13 - Documents

Issued page, and enter the details.

10. Submit your returns and e-sign.

GST Reports full details in Tally Erp9 in Hindi

Purchase, Sales Entry in Tally with GST

Method 2: Using GST Offline Tool

Export GSTR-1 returns in the MS Excel or CSV Format

1. Go to Gateway of Tally > Display > Statutory

Reports > GST > GSTR-1 2. F2:

Period: Select the period for which returns need to be filed.

3. F12: Configure: To view the

export options for HSN/SAC details, enable Show HSN/SAC Summary?

4. Press Ctrl+E.

5. Press Enter to export.

GST IN HINDI, GST EXPLAINED, ADVANTAGES OF GST, GST MEANS

Import data and generate the JSON File Format

1. Open the GST Offline Tool.

Ensure that you download and install the latest version of the GST Offline

Tool. Click here for more details.

2. Click NEW.

3. Provide the required details, and

click PROCEED.

4. Click IMPORT FILES.

5. Click IMPORT EXCEL, and select

your file.

6. Click YES on the warning

message, and click VIEW SUMMARY.

7. Click GENERATE FILE.

The offline tool generates a JSON file that has to be

uploaded on the GST portal.

GST क्या है, जीएसटी पंजीकरण ऑनलाइन कैसे करे

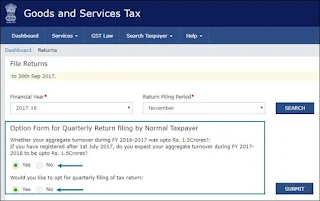

Method 3: Filing GSTR-1 Returns directly on the GST portal

1. Log in to the GST portal.

2. Go to Services > Returns > Returns

Dashboard, and click Prepare Online.

3. Select the Return Filing

Period, and click Search.

4. Open each GSTR-1 table, read or

copy data from Tally.ERP 9, and fill the tables.

5. Submit your returns and e-sign.

GST TYPES AND USES IN HINDI SIMPLE

जीएसटी रिटर्न ऑनलाइन कैसे फाइल करें

GST क्या है, जीएसटी पंजीकरण ऑनलाइन कैसे करे

GST IN HINDI, GST EXPLAINED, ADVANTAGES OF GST, GST MEANS

अंत में

आशा है की पूरी पोस्ट पढने के बाद आपको Tally में GSTR-1 रिपोर्ट को टैली से सीधे ही GST Portal पर अपलोड करना आ गया होगा.

GST Reports full details in Tally Erp9 in Hindi

Purchase, Sales Entry in Tally with GST

Difference between Accounts Only and Accounts with Inventory in Tally in Hindi

Difference between Tally Educational Mode and License Mode in Hindi

0 टिप्पणियाँ

Please Submit Own Valuable Comments For This Post